The fundamentals behind our real estate market are strong, and understanding that is critical to identifying the direction that the real estate market is headed going forward. Many Canadians were spooked by the announcement that the Premier of Ontario was going to be implementing a 15 percent foreign buyer tax along with a number of other measures falling under Ontario’s Fair Housing Plan. The interesting thing was that none of these measures actually accomplished anything. What they did do, as intended, was scare buyers and sellers into temporarily pulling back. This was another attempt by the Ontario government to improve their record low approval ratings, this time by trying to “cool the housing market”. Fortunately, fear can only have a temporary effect. In time the fundamentals of the market always prevail.

The Importance of Fundamentals Within the Real Estate Market

It’s no surprise that the market has performed as well as it has over the last five to 10 years. There is no silver bullet behind prices being driven up as quickly as they have. What it comes down to is fundamentals, and when looking at all the fundamentals as of this moment, they all point to a very strong and robust real estate market that should continue to grow.

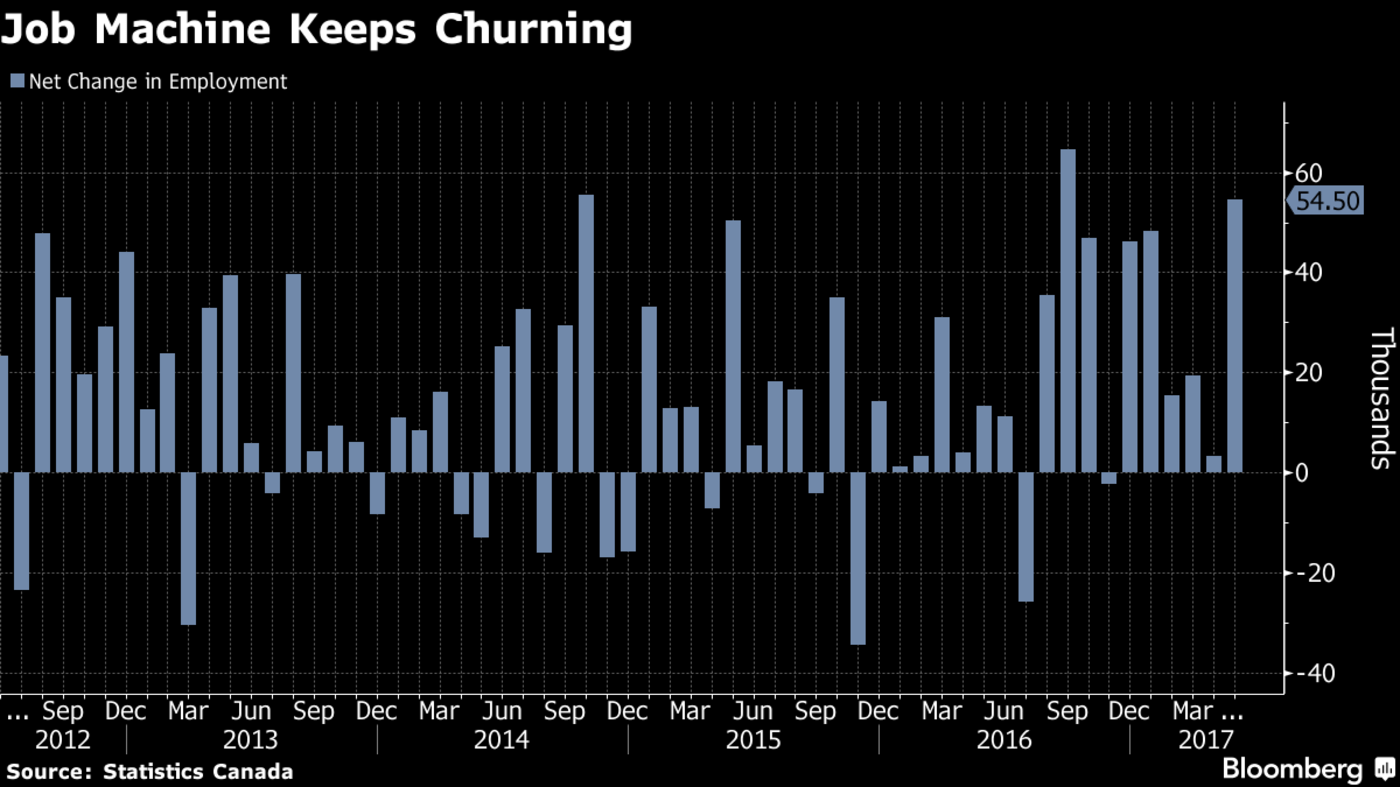

Bloomberg Chart – Canada Adds 316,800 New Jobs

Bloomberg Chart – Canada Adds 316,800 New Jobs

On the national front, Canada has created over 300,000 new jobs in the last 12 months, with the majority of those located in the Greater Golden Horseshoe and Greater Vancouver area. We have even surpassed the United States in growth for 2017. Canada’s economy is growing faster than any of the world’s largest economies. Unemployment is low, despite public perception, and it is continuing to fall. Wages, of course, are finally growing again. When wages grow, there’s more money to spend, and typically, inflation starts to play a part. House prices, the cost of goods and the cost of services will all increase as people have more money in their pocket. A strong economy traditionally means a strong housing market.

Canada’s Recovery in Oil and Gas

Perhaps most importantly, Canada has recovered from the oil shock. A few years ago, oil dropped from over $100 a barrel to under $50 a barrel in approximately six months. Canada is one of the world’s largest oil producers, and our economy is heavily dependent on natural resources such as the oil out west. When oil is $100 per barrel, that means more money for businesses, more money to hire, and, consequently, more jobs and more tax revenue. In 2015, suddenly, one of the largest tax generators for our economy was cut in half virtually overnight. This drag on growth affects the entire Canadian economy and puts negative pressure on the housing market. The Bank of Canada has stated that the Canadian economy has finally weathered this storm.

Rising Interest Rates Remain At Historic Lows

Interest rates remain at historic lows, and despite the potential that they may rise in the coming months, they still remain historically low. A rate increase only further shows that the Bank of Canada believes the economy is very strong. They would never risk increasing interest rates if they thought it would have a negative impact on housing; housing is one of the largest sectors of the Canadian economy, making up almost 20 percent of GDP.

Interest rates affect everything: purchases of cars, goods and credit. Consequently, talk about raising interest rates truly signals that we are in a very good place and that we have finally come out of the economic turmoil that we have experienced since the 2008 recession. Rising rates mean a strong economy which is good for the housing market. At the same time, those rates remain historically low which again supports a strong real estate market as credit remains very affordable.

Supply-and-Demand Issues Are a Symptom of a Highly Desirable Environment

On the local front, supply and demand is still a major issue in the Greater Golden Horseshoe. Nothing has changed or will change on that front anytime in the foreseeable future. The Premier’s Fair Housing Plan did nothing to address supply and demand, so those issues still remain. Close to 150,000 immigrants arrive in the Greater Golden Horseshoe every 12 months, and, of course, migration is still occurring at high rates, as young people and others from the majority of Canada’s provinces migrate to the area to seek employment, education… and just to start lives.

We simply cannot build enough homes to suit everyone who is moving in. We are a desirable place and that is a good thing, even if it puts pressure on prices making it a little more difficult for people to purchase. This is a big opportunity for communities surrounding the Greater Golden Horseshoe, as these communities are going to begin to grow significantly for the first time in decades as people begin to move outwards. At the same time, the province has placed a development barrier around us called “The Green Belt,” and is actively working to expand it. This means we can no longer build out. As each year passes it will become increasingly more difficult to build any low rise housing.

If they were seriously concerned about the housing market, they would address the supply-and-demand issue; they would force municipalities to start growing upwards or extend those boundaries and allow us to spread out farther. They have made it clear that this will not happen. That is the one major piece to this puzzle. If we cannot grow either up or out, then we are going to remain in the same position that we have been in for the last 10 years, and we will continue to see a lack of single-family homes and upward pressure on prices. More buyers than houses = prices going up.

The Market Is Shifting to Condos Rather Than Single-Family Homes

At the end of May, there were 10,820 new homes available to buyers in the GTA, of which 9,406 were condos. Only 1,414 were low-rise, single-family homes. In May 2006, there were 29,754 new homes in builder inventory in the GTA, of which 16,420 were low-rise, single-family homes. So, you can see that there are virtually no single-family homes being built. We cannot spread out any farther, and these numbers justify that. Month after month, we are seeing the same situation as far as the numbers go, and we are seeing a massive shift toward condos and urban development, which is what the province wanted. This is good for the economy and the environment as it is a more sustainable way of living. This is also something that the next generation desires.

Hamilton’s Pier 8 Development

At the same time, there is still a large percentage of the population that is seeking single-family homes, and it will take time for people to adapt to this new way of living. We have a massive pent-up demand of people who are looking for single-family homes, and every year that goes by, this inventory is decreasing to the point where there’s virtually none anymore. This is why we are seeing explosive growth in the prices of low-rise homes. It’s not foreigners or any other media/government scapegoat; it’s a simple supply-and-demand issue, and the numbers say it all.

A lack of affordable low-rise inventory is why we have seen a sudden jump in condo prices in the last 24 months. Buyers are now shifting to the condo market in droves. At the same time Baby boomers are now starting to sell their homes in the suburbs and move into urban condos where they can enjoy the many amenities that this lifestyle offers. All of this puts upward pressure on condo prices and fuels further condo development in our urban areas.

Hamilton Continues to Grow and to Recover

On a local level, Hamilton’s going to continue to see a major influx of buyers from the GTA. They are moving in our direction to seek single-family homes, because, of course, our single-family homes are much more affordable than homes in the GTA. A home valued at $500,000 in Hamilton would cost $1.5 million just 45 minutes north in Toronto. The majority of people purchasing, whether it’s for an investment or to occupy, are interested in our single-family housing stock. The GTA buyers are specifically coming here for this. The condo market in Hamilton thus far is mostly local driven.

Prices will never become affordable for the average person to own a home again in Toronto. Two to three out of every 10 buyers here are coming from the GTA to buy our single-family homes and that isn’t changing anytime soon. This will continue to put pressure on our prices.. The local market is strong: Jobs are being created, wages are growing, and the city is adding shops, restaurants and other amenities on a near weekly basis.

Toronto developers and other national development players are coming into Hamilton. In the last month, we have seen Lamb Development Corp. announcing a $350 million dollar new development, called Television City coming downtown.

Television City By Lamb Developments

We are at the beginning stages of our rebirth. There is a ton of development coming. Our pipeline is increasingly filling as time goes, with new development applications, concepts and purchases of land for future development. It’s going to take time until all of that sees the light of day, but it’s happening. Our new transportation systems, such as the West Harbour Go Station and the LRT, are set to come online within the next few years, and once they are finished, we will see a ton of economic impact all over the city.

It’s really a once-in-a-lifetime situation for Hamilton; we’re recovering from two decades of decline, and I’m confident that Hamilton is coming back and that very soon we are going to be in a position where we can safely say that Hamilton is stronger and better than it’s ever been. These are the things that you need to look at when judging whether a real estate market is healthy or whether it’s set to go up or down over time. All fundamentals are pointing to positive growth in the real estate market. As far as Hamilton is concerned, there’s never been a better time to get into the market. As the chinese like to say “The best time to plant a tree was 20 years ago. The second best time is now.”